“All them spam calls started right around 6 AM today,” says Wade Cookson, an eighty-year-old senior living in Flordia. “All of them telling me I have free health insurance waiting for me.”

Wade is one of thirty people who contacted us about telemarketing calls and tried to force them to sign up for free health insurance.

“When I answered the phone, the person greeted me by my name,” says Grace Rameriz, a ninety-three-year-old senior living in California. “She told me I qualify for free health insurance and should enroll today.”

Ms. Rameriz said she tried to tell the person calling that open enrollment ended on 15 January, but the person calling would not be deterred.

“I was told President Trump has extended open enrollment until the end of summer,” says Ms. Rameriz. “She responded by saying that I was on a presidential list for free insurance, and then she told me my date of birth and social security number. I hung up and called my granddaughter.”

“I told my grandmother,” says Amy Ryan, “this is a scam, and no one should have your social security number. I reported the call to the police.”

Open enrollment for the Affordable Care Act (ACA) Marketplace opened for 2025 health insurance coverage on 1 November 2024 and ended on 15 January 2025.

“My phone started ringing at about five this morning,” says Danial Guzman, a seventy-nine-year-old man living in New Mexico. “The number had a 575 area code, and I answered, “ I thought it might be someone I know.”

Like everyone else I’ve spoken with, Mr. Guzaman was offered free health insurance, a benefit provided by the president to seniors.

I decided to call one of the numbers provided to me.

The person who answered the phone said, “Hello,” without indicating who I was calling. I told them that I had a missed call from them.

I was met with a sales pitch for health insurance offered to seniors under an executive order from President Trump. The woman on the other end of the line read off a list of benefits that would make anyone sign up: no deductible, free prescriptions, zero copays, and the ability for insurance to pay a family member to care for you.

She then told me that my information did not populate on her end and that it might be an error they called me. She asked me for my name, date of birth, and social security number. My answer was complete fiction.

She thanked me after repeating my information and asked for a moment while she validated what I provided her. She hung up. When I called back, the call was answered and quickly disconnected.

I decided to call Martha De La Cruz, an advocate for the elderly in New York City, and explain to her what others have told me. I also put her in touch with those who contacted me.

“This shows that we need to better protect and secure the vital data of our elderly population,” said Martha. “The fact that the caller knew the names, dates of birth, and social security numbers of each person that called is frightening. I fear they are looking for a way to access these people’s accounts or open new credit accounts under their names.”

Ms. De La Cruz went on to tell me about data brokers.

Data brokers collect, analyze, and sell or license large amounts of personal information to third parties without consumer consent.

“There are websites,” says Martha, “where you can sign up and receive information such as dates of birth, social security numbers, and more for a monthly fee.”

What can you purchase from a data broker? A whole host of information, including your name and address, and more sensitive information like income, employment history, and even online activity. In some cases, your date of birth and social security number.

“Your personal informaiton is for sale,” says Marth De La Cruz. “Many states sell off your personal information for profit through their Department of Motor Vehicles. This leads to scam calls, such as the ones your readers reported. Information sales still occur even with the national Drivers Privacy Protection Act in place.”

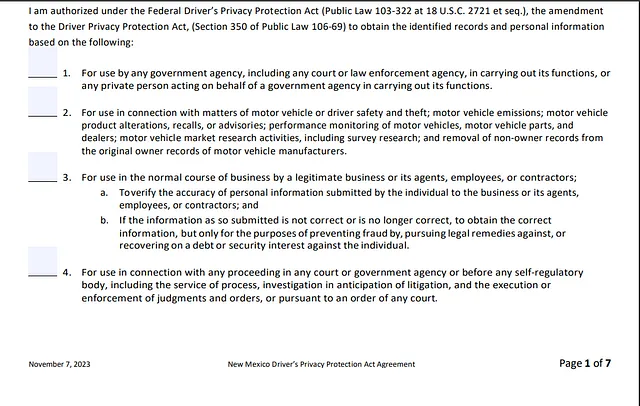

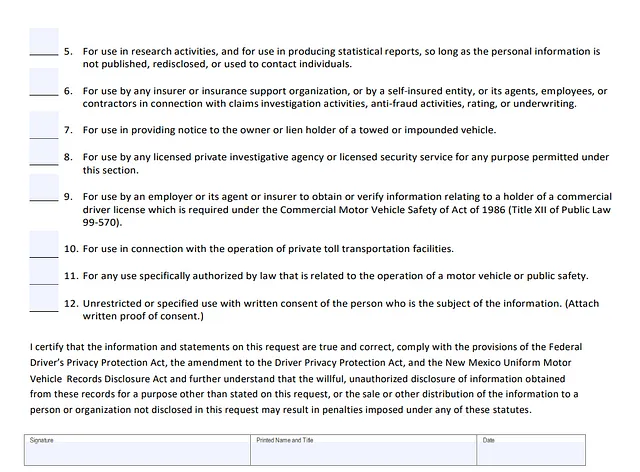

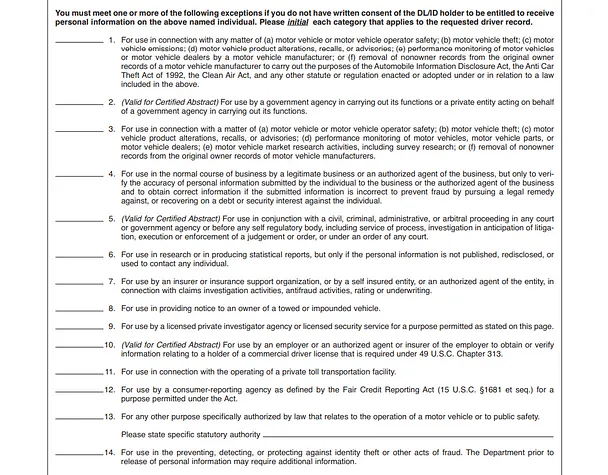

The Drivers Privacy Protection Act (DPPA) covers information such as name, address, driver’s license or ID number, social security number, phone number, medical information, and more.

There are exceptions to this DPPA, and you can still obtain that protected information simply by clicking a box on a request form, as shown in the screen captures at the bottom of this article. These are from Texas and New Mexico.

“There are even firms, such as Captured Investigative Agency, in Missouri, that you can hire to gather these records on your behalf,” says Martha.

In the end, I met with Danial Guzman and, using his phone, called the insurance broker who had called him.

When I called, they answered, saying, “Good morning, Mr. Guzman,” and then began telling me how good their insurance was. If this was legitimate, it would be a great product.

I was told that to obtain coverage, I would be sent to a third-party verifier who would ask me questions, and all I would have to do was answer yes to each one.

I ended the call after asking the first question: “Do you authorize us to use your name, date of birth, and social security number to obtain accounts under your name?”

“This is almost like the calls that, as soon as you answer, you are asked if you can hear them,” says Ms. De La Cruz. “The scammer wants you to say yes so that they may record you and use your voice to authorize fraudulent charges, transactions, and account changes.”

Ms. De La Cruz provided ways to protect your data and that of older family members.

To prevent your personal data from being sold, limit data collection, opt out of marketing associations, use a VPN, and monitor data brokers regularly.

1. Limit Data Collection and Sharing:

- Be mindful of what information you share online: Avoid sharing unnecessary personal details on social media or other websites.

- Review privacy policies: Understand how websites and apps collect, use, and share your data.

- Opt out of marketing associations: Many companies offer options to opt out of using your data for marketing purposes.

- Use a VPN: A Virtual Private Network (VPN) encrypts your internet traffic, making it harder for third parties to track your online activity.

- Minimize data collection: Organizations can protect personal privacy by limiting the amount of data they collect.

2. Secure Your Accounts:

- Use strong, unique passwords: Don’t use the same password for multiple accounts; choose passwords that are difficult to guess.

- Enable two-factor authentication: This adds an extra layer of security to your accounts, even if someone gets your password.

- Regularly change your passwords: This helps to prevent unauthorized access to your accounts.

3. Monitor Your Data:

- Monitor data brokers: Data brokers collect and sell personal information, so it is essential to monitor and remove your data on these sites regularly.

- Use data privacy tools: Many tools can help protect your personal information and prevent it from being sold to third parties.

4. Protect Your Devices:

- Back up your data: Regularly backup your data to prevent loss and ensure a secure archive of important information.

- Secure your devices: Use strong passwords and enable two-factor authentication.

- Safely sell, trade, or dispose of your devices: Ensure all accounts and services are unlinked from the device before selling or disposing of it.